With just how many types of online payments there are nowadays, it can be difficult for bettors to find and choose the banking solution that fits them best. There are payment service providers that stand out due to their stellar performance and reputation, however, and Interac is one such company.

In fact, the company has taken the nation by storm. It has a great range of services to take advantage of, and the most relevant to punters are Interac Online and Interac e-Transfer. The latter is a bank transfer service that is tied to your financial institution, and transactions occur through the use of email. Depositing money into your sportsbook balance is quick, and this is greatly appreciated by sports bettors. What is more, it can even be of use when it comes to withdrawals. Interac Online is similar, although it lets you use your bank account in a more direct manner. It is also quite useful and allows for seamless deposits.

All in all, Interac is beloved by bettors and regular users alike, and these are its best traits:

- Reliability – Interac is easy to use and you can almost always count on its services being available.

- Security – Interac employs some of the strongest cyber-security measures currently available.

- Interac e-Transfer can be utilized for both deposits and withdrawals – a rare and welcome sight at sportsbooks.

Interac is an institution that first emerged in 1984. It was the result of 5 prominent financial institutions’ combined efforts to create a non-profit shared banking network for the convenience and comfort of Canadians. Suffice to say they more than succeeded in achieving their aspirations. The nonprofit was a success, and it was not long before other banks became members of the then-named Interac Association. A little over a decade later, the for-profit Aspyx was formed by the founders of Interac Association, and it provided additional Interac services. The two joined forces in 2018, creating the currently operating Interac Corporation.

Interac Overall User Experience

Interac is an easy-to-use financial solution, and much of that is owed to the fact that it is available within a bettor’s bank account. This makes for a familiar and comfortable to utilize since many punters are used to their bank accounts.

Interac’s main website is mainly an information hub and a great one at that. However, this is its main purpose. If you wish to actually use Interac’s transfer services, you will, as mentioned above, need to do so through your financial institution.

Enrollment is a quick and hassle-free task. Typically, you will find the option to opt into using Interac via your account settings page. Most banks tend to have a clean and easy-to-navigate interface, so finding Interac among the other listed account options is effortless.

The same can be said about the typical smartphone application of a Canadian bank. They tend to be available on both Android and iOS and to have simple and well-optimized layouts that allow for easy management of one’s finances on the go.

As for the types of Interac options you could find, there are several, the first of which is Interac e-Transfer. In a nutshell, Interac e-Transfer is a service that lets you easily send money from your bank account to your sportsbook’s bank account and vice versa. The service functions with the help of emails sent to the sender and recipient. This is by far Interac’s most utilized product and for good reason, seeing as its ease of use is pretty much unmatched in Canada. It is also the option you are most likely to find at your financial institution and your Canada-friendly sports betting website. In addition, you can make deposits and withdrawals with Interac e-Transfer which is yet another one of its perks.

Interac Online is similar to Interac e-Transfer, except it is far more direct. The process tends to be faster, and in this case, you are simply using a gateway by your sportsbook in order to transfer money to your bookie balance. Unlike e-Transfer, emails are not necessary, and another difference is that this solution is fairly rare to find.

There are also several other services, of which Interac Debit, used with Google Pay, Samsung Pay, or Apple Pay like any other card, can be of great use. If you wish to use one of these specific solutions, Interac Debit is another option.

Registering an Account with Interac

When it comes to making use of Interac’s services, most bettors will find it exceptionally easy. All you need is to have an online banking account with your financial institution, which will be the case for the majority of bettors who wish to try out these services.

There is no need to worry if you do not have such an account, however. The steps needed to create one and then start utilizing what Interac has to offer are simple and straightforward. If you are a customer of Royal Bank Canada, for instance, registration will proceed as follows:

- Pay a visit to your financial institution’s website and find the designated online banking section.

- Enroll and provide the necessary information. If you are already a client of your bank, this entails your bank card’s details

- Next, you will receive an activation code that needs to be used.

- The last thing you have to do is to create a password.

As you see, the process involves nothing cumbersome. Do note, however, that as we mentioned, the process might differ slightly depending on your own financial institution. Make sure to follow the instructions carefully, and read up on any additional guides on the website when available.

If you find yourself stuck, do not panic, and get in touch with an agent of the bank’s customer support team. Most banks provide 24/7 customer service, and it is offered either through live chat, telephone, or email, so do not hesitate to contact someone if you need to.

In addition, you also have the option of opening an online banking account at one of your financial institution’s brick-and-mortar venues.

In terms of the currencies you can use, it all depends on your bank. CAD is available by default, but conversion is typically offered when necessary. Sportsbooks geared towards Canadian bettors tend to support CAD, though, so it is unlikely that you would ever find conversion necessary when you wager on sports.

| Interac Registration Requirements | |

|---|---|

| Copy of ID/DL | no |

| Utility Bill | no |

| Link bank account | yes |

| Link bank card | yes |

Depositing with Interac

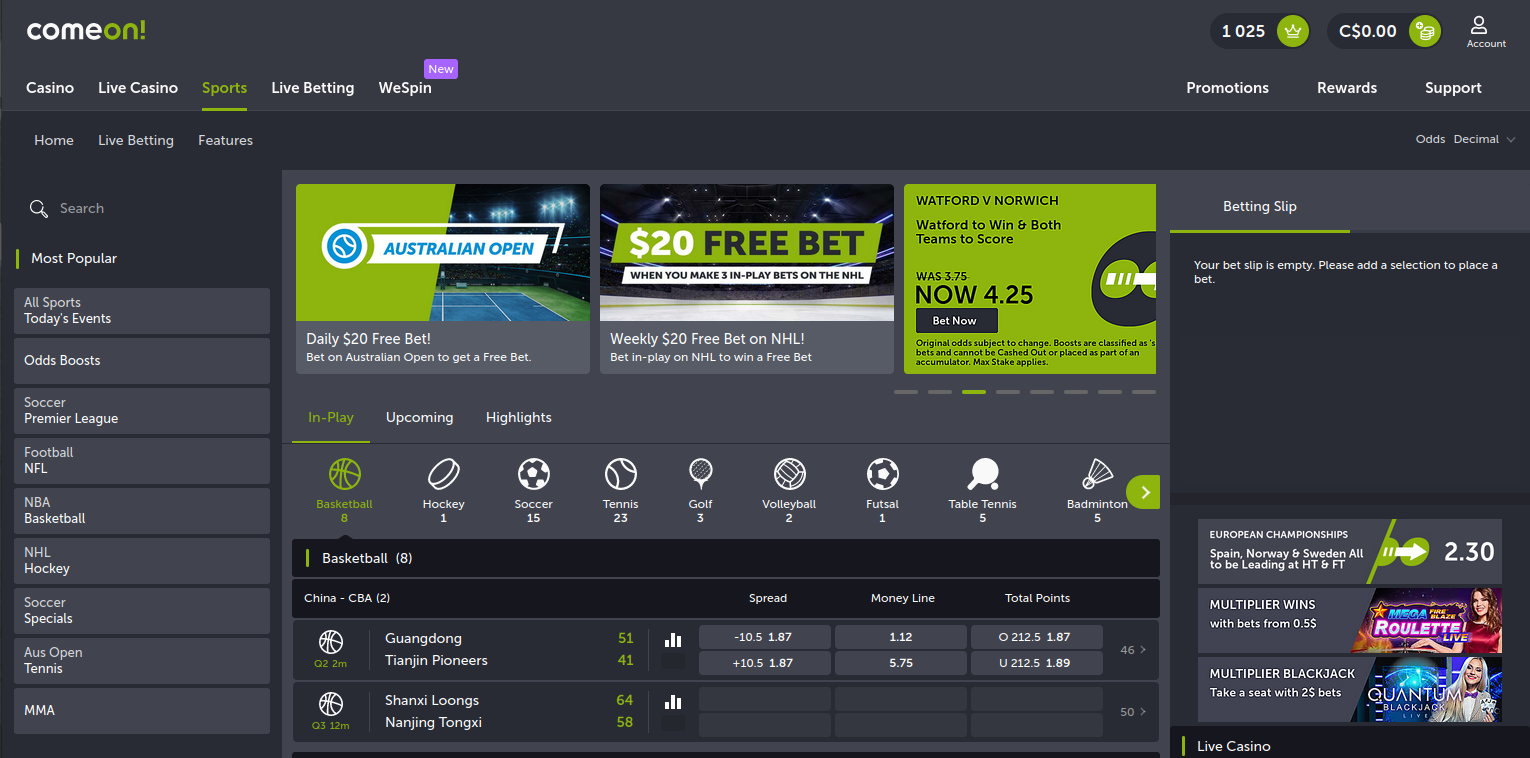

Being able to easily deposit to your sportsbook balance is one of the most crucial aspects of a bookmaker since money is the main cog of the mechanism that makes sports betting work. It is thus best for the process to be as effortless as possible for punters, and thankfully, Interac betting sites have, indeed, made it quite easy. As a bettor, these are the steps that you will need to take:

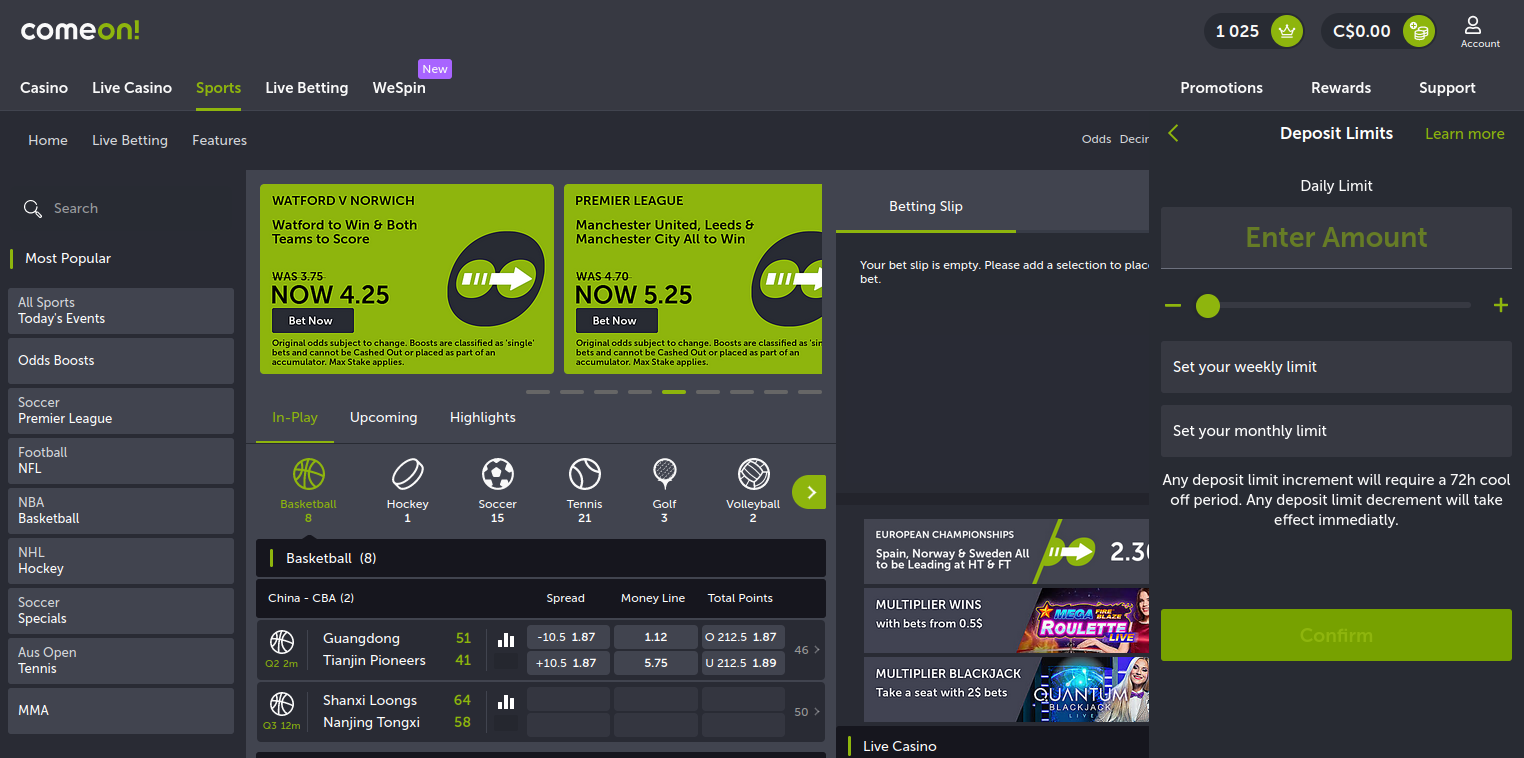

- First, navigate to the deposit section of your sportsbook.

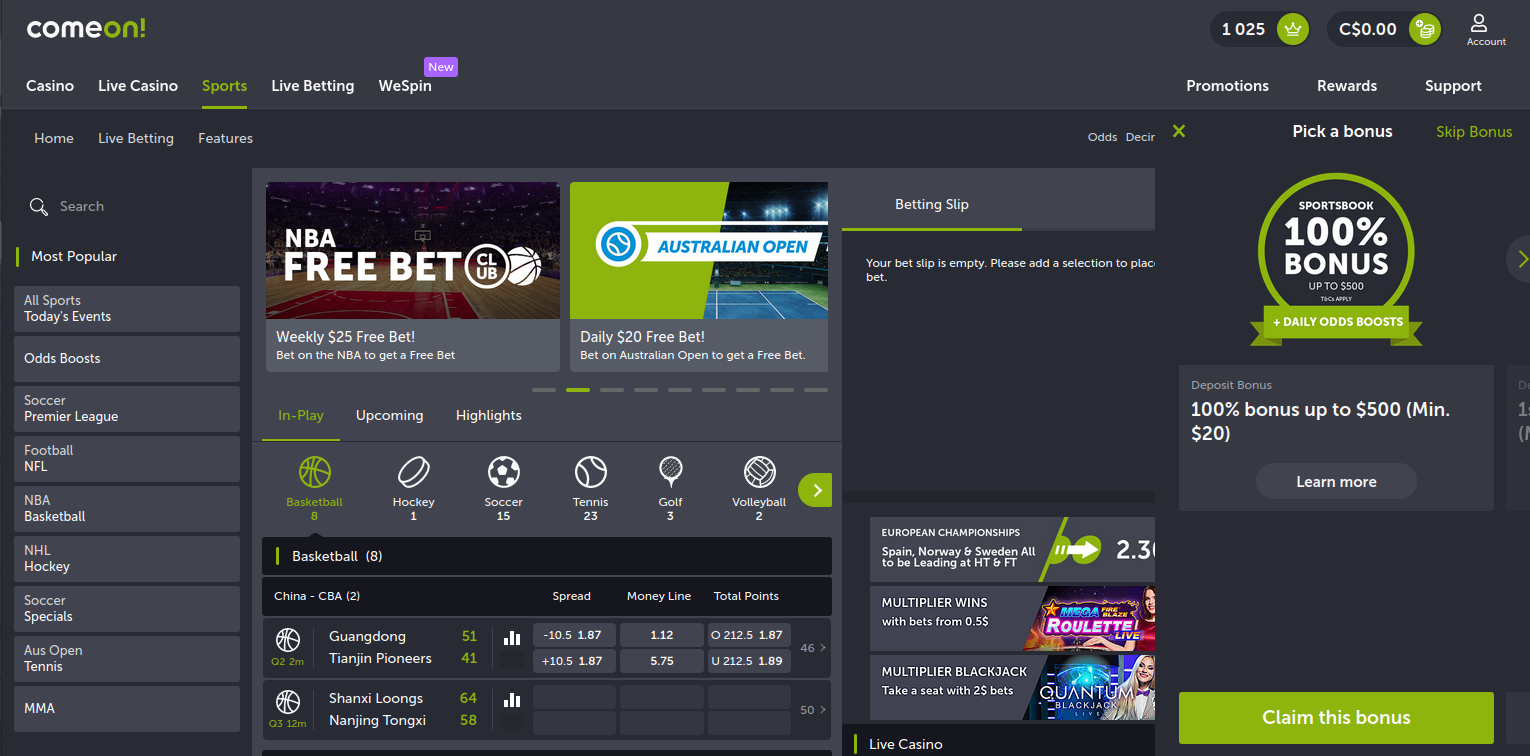

- If a sportsbook offers promotions, this is often the point at which you can opt-in.

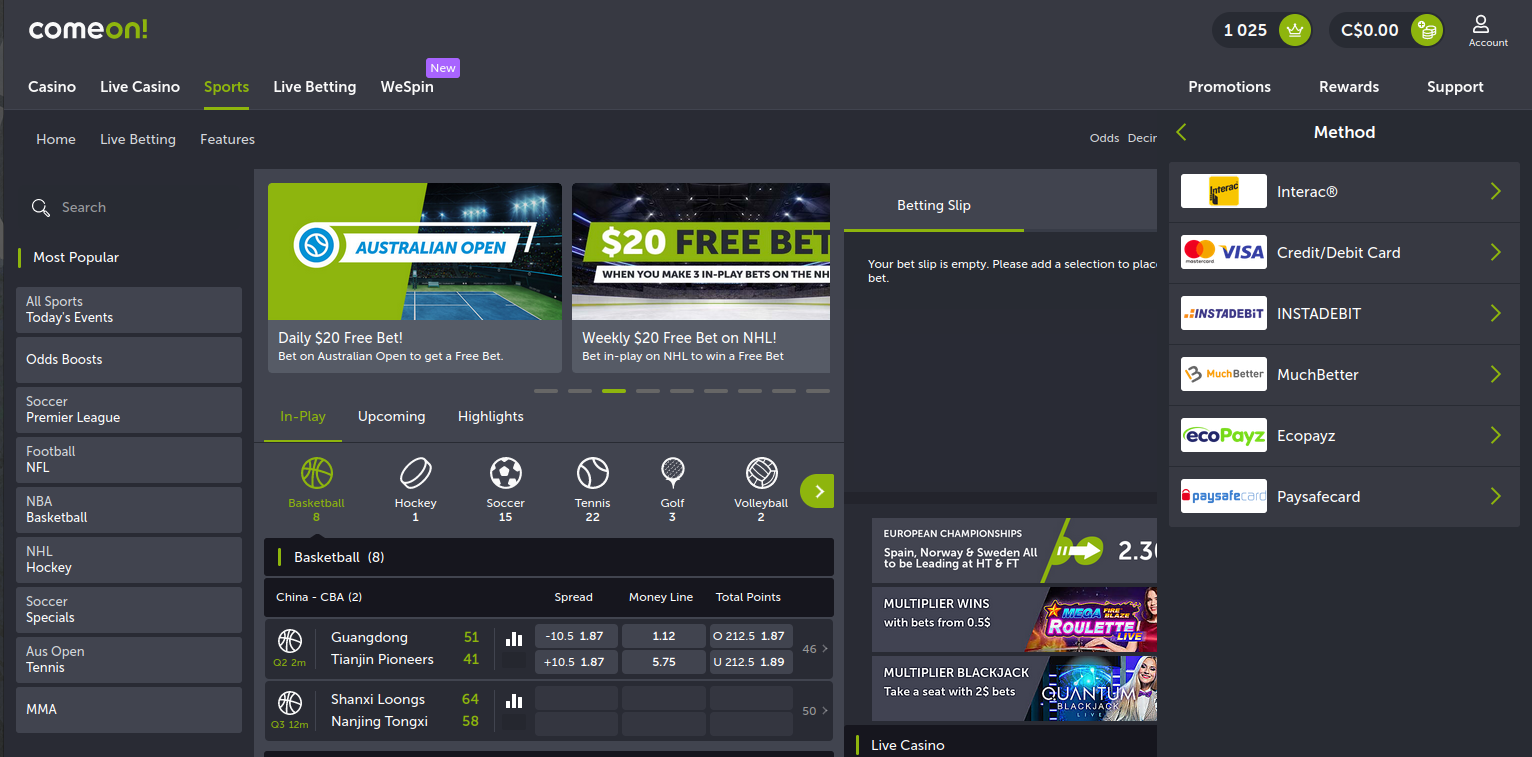

- Next, you will be presented with a list of deposit options to pick from. Choose Interac.

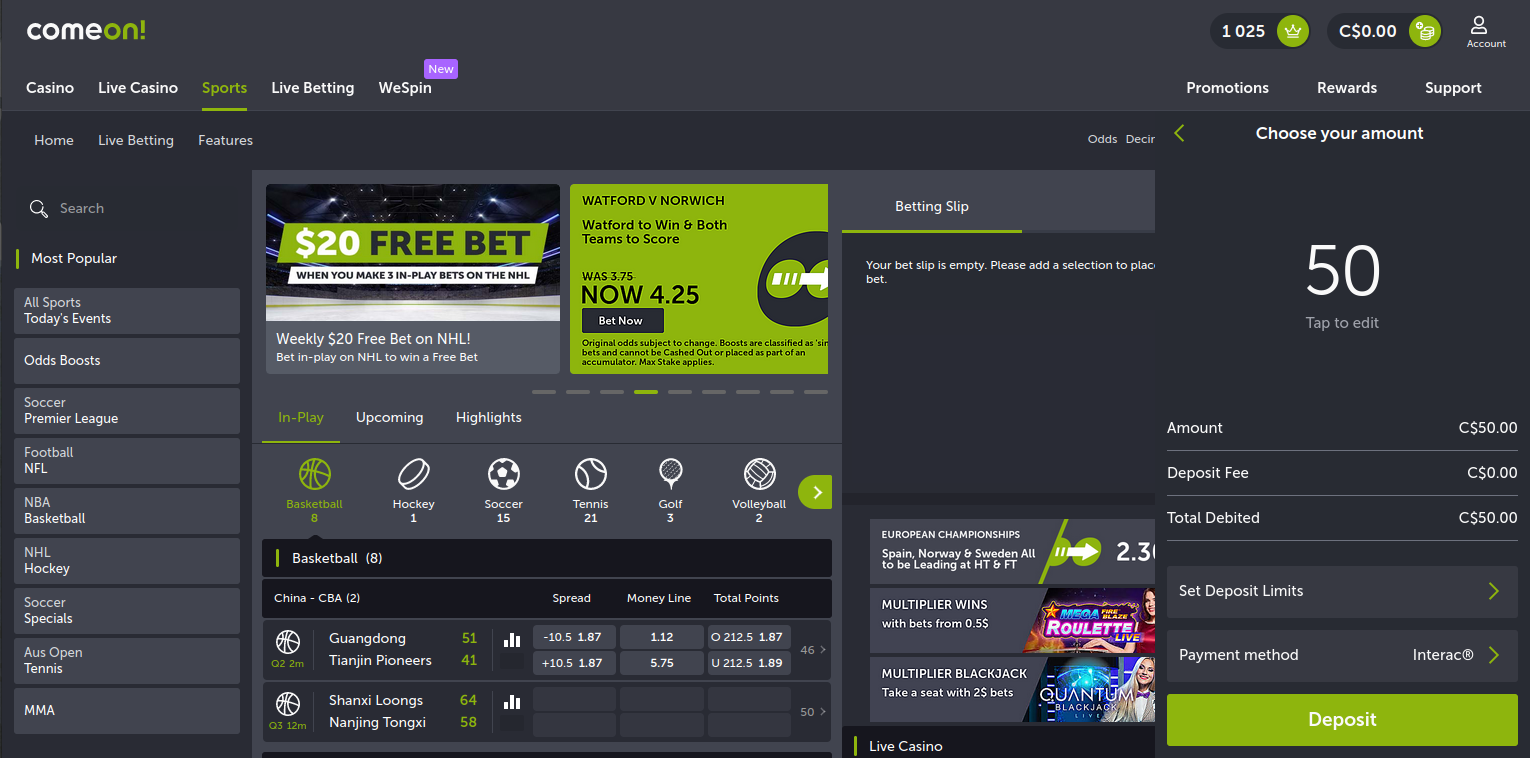

- Decide how much money you will deposit.

- In addition, if you have not already set daily, weekly or monthly limits on how much money you can deposit, this is when you will again be presented with the option.

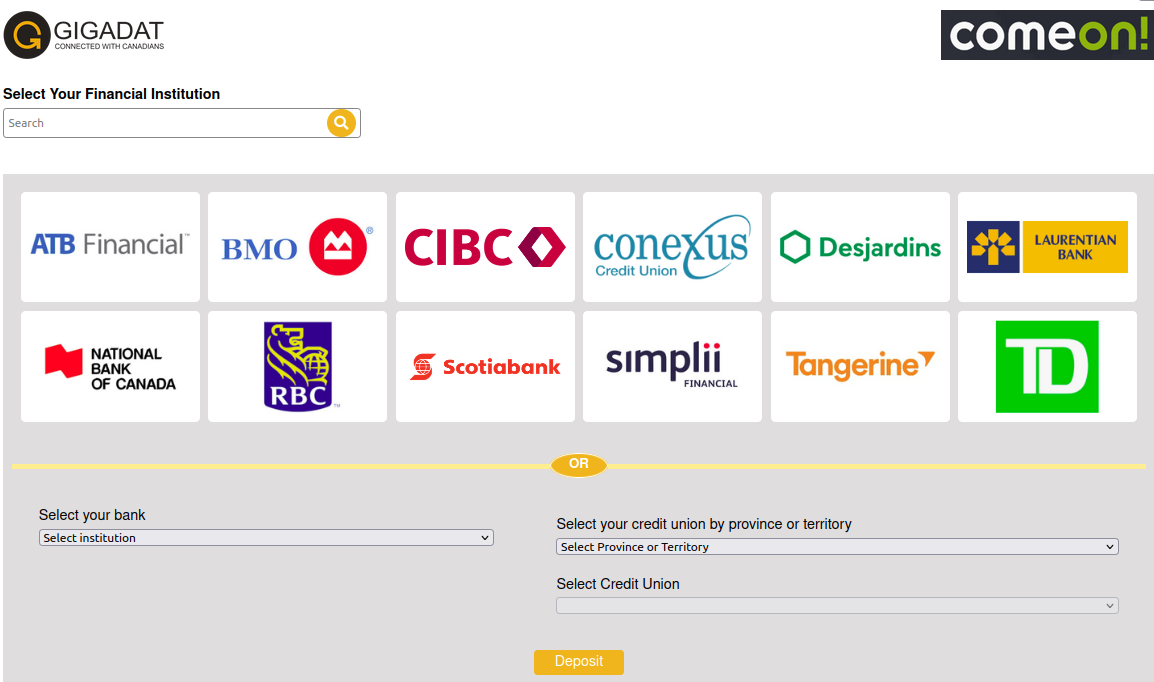

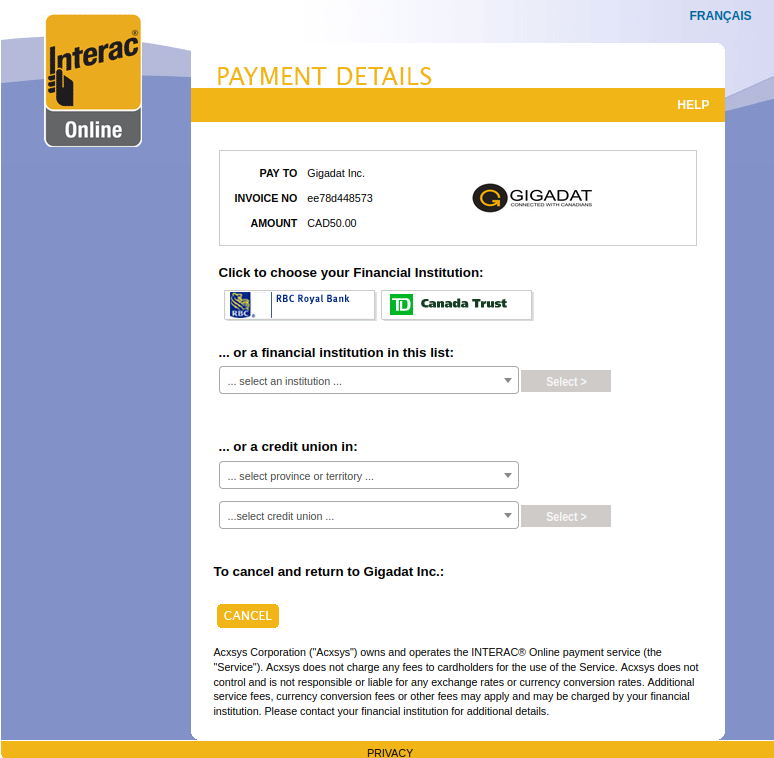

- Afterward, you will be redirected to Gigadat’s page, and here you can choose your financial institution or credit union. Gigadat and Interac Corporation work together, so no need to worry.

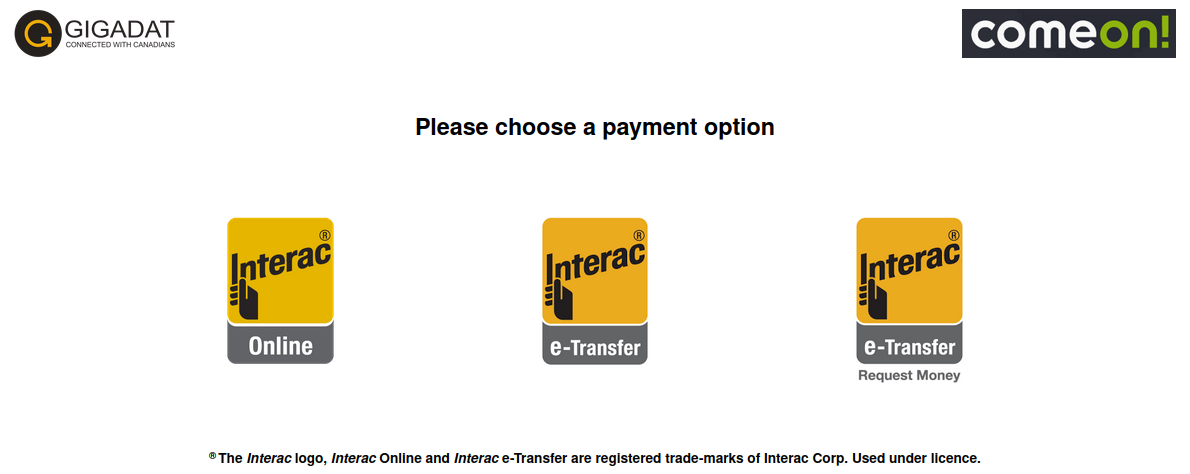

- Then, you will have several options to pick from.

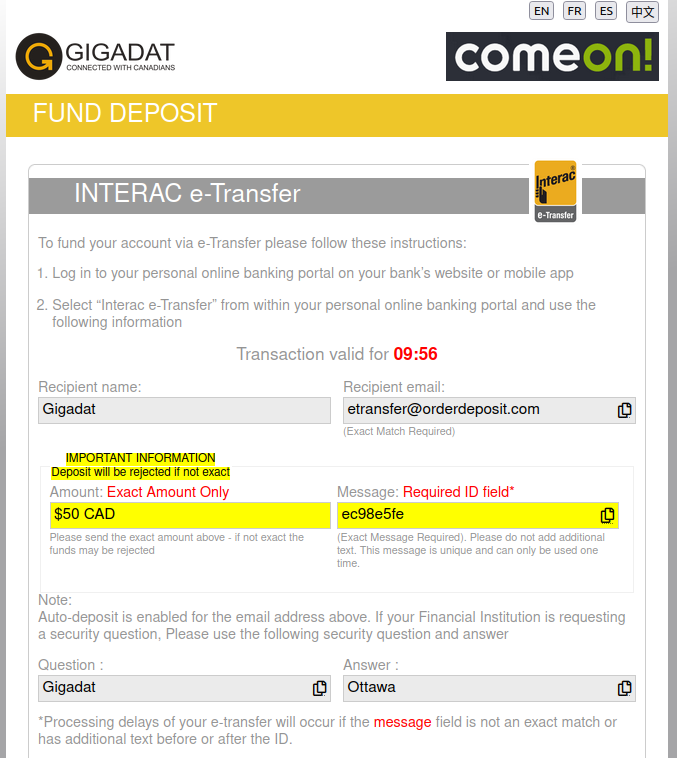

- Choosing Interac e-Transfer will lead you to another Gigadat page, this time containing all of the information necessary to deposit money into your bookie. You will need to navigate to your own bank’s website, select Interac e-Transfer, and input the provided information in the designated fields. With this, your Interac e-Transfer will be finished and you will be ready to embark on your wagering journey.

If you had picked Interac Online, then the process would be even shorter:

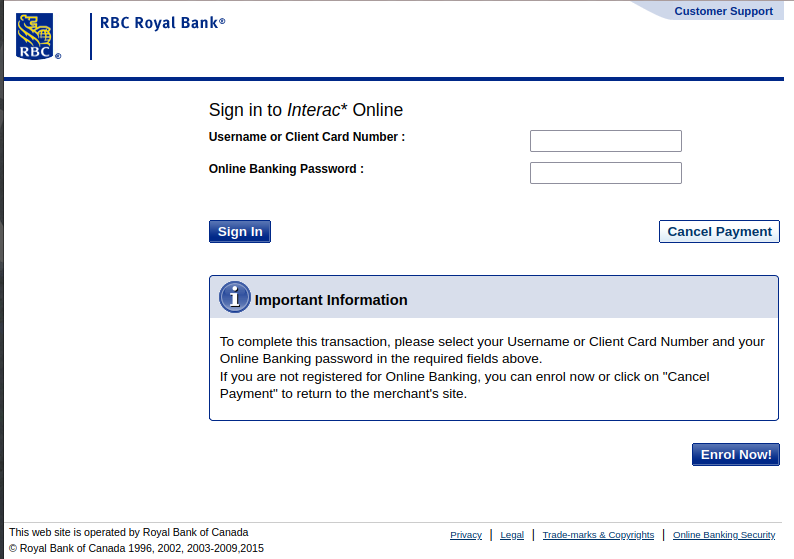

- After choosing your bank account, you will be redirected to another page and prompted to confirm your choice of a financial institution.

- You will be redirected to your bank’s page, where logging in with your username or client card number, and your password will be necessary. Confirm the payment, and that is pretty much it.

As always, check beforehand what the minimum and maximum deposit limits are, especially if you wager at multiple sportsbooks. In addition, as stated previously, you will often be offered promotions whenever you make deposits. Try avoiding rushing into such a bonus without reading the terms and conditions first, as you will often be prevented from taking advantage of another offer this way.

| Depositing with Interac Summary | |

|---|---|

| Timeframe | Instant |

| Minimum per transaction | $10 |

| Maximum per transaction | $5,000 |

| Fees | Bank dependent |

| Available currencies | CAD |

Withdrawing with Interac

Apart from deposits, there is no denying that withdrawals are just as important as deposits for any sports betting fan. Reaping the benefits of your hard-earned winnings is pretty much all that matters to certain bettors, actually, which is perfectly understandable.

Thankfully, Interac does not disappoint in this regard either, because withdrawing one’s funds is an absolute breeze:

- You will again need to find your sportsbook cashier and click withdraw.

- Like before, you will have a certain number of choices to pick from. There might be fewer alternatives this time, and this is typical since withdrawal methods are not as numerous as a whole. Either way, when you find Interac, you can continue.

- Answer the security question.

- You will then have the opportunity to input how much money you wish to withdraw.

- Choose your own financial institution.

- You will then be navigated to another page, where you will need to use your log-in details and authorize the transaction.

As for when you will receive your money, the time-frames of withdrawal processing vary from bookie to bookie. You can typically expect to receive your funds within several days, but either way, it is best to look up this information on the bookmaker’s website in order to avoid unpleasant surprises.

| Withdrawing with Interac Summary | |

|---|---|

| Timeframe | Up to 3 days |

| Minimum per transaction | $10 |

| Maximum per transaction | $10,000 |

| Fees | Bank dependent |

| Available currencies | CAD |

Fees Related to Interac Betting

This is not the most pleasant of topics for gambling aficionados, but nonetheless, it is important to keep oneself informed. First, be prepared that you might be charged fees for Interac e-Transfer transactions by your financial institution. The amount you will be charged with tends to vary between banks. At Royal Bank Canada, for instance, those with a personal savings account pay $1.00 per Interac e-Transfer transaction. As implied, the fee amount may also vary between banking plans, and certain packages might even remove some fees altogether, so it is a good idea to check and contact a representative of your financial institution for more information if needed.

Another, although less common, way you could encounter fees, is through your sportsbook, as bookies may charge you for withdrawals via Interac. This is very rare, however.

As for fees related to Interac Services, they will vary from service to service. For instance, Interac Debit ABM withdrawals will result in a $0.010123 switch fee. If you use Interac e-debit with services such as Google Pay, Apple Pay, or Samsung Pay, the sum you will be charged amounts to $0.025. As for interchange fees, ABM withdrawals are subject to a $0.75 flat fee per transaction. Interac Debit transactions are free, while a $1.80 flat fee is applicable to transactions conducted via Apple Pay, Samsung Pay, and Google Pay that are valued at $300. Last but not least, acquired service fees related to Interac Debit for online payments are met with a $0.015 cost for most transactions.

| Fees Related to Interac Summary | |

|---|---|

| Initial setup | no |

| Account review | no |

| Maintenance fee | no |

| Inactivity fee | no |

Benefits of Betting with Interac

Interac is extremely popular within its country of operation. More and more individuals opt for using its services, and Canadian punters are no different.

There are lots of reasons behind this widespread usage. First, the quality of what Interac provides to its users is impeccable. Deposits are speedy, while withdrawals are quite easy to conduct. This is especially relevant to bettors who need to deposit into their sportsbook account fast so that they can immediately start partaking in their hobby.

Speaking of which, the fact that Interac can be used for withdrawing one’s winnings at sportsbooks is also crucial to understanding Interac’s popularity among sports betting aficionados. Very few payment solutions offer both deposits and withdrawals when it comes to wagering on sports, so this is quite the appreciated feature when it does pop up, to say the least.

Lastly, security is an aspect that bears emphasizing. With Interac, you can be certain that you are provided with a secure transferring experience. The company behind Interac encrypts your information, and users are also able to take advantage of the security features their banks offer due to how closely Interac is tied to one’s bank account.

All in all, everything together forms an impressive package that is more than worth considering for the average bettor.

Drawbacks of Betting with Interac

Although Interac’s products are excellent overall, they do come with some setbacks that should be put into consideration before you decide to go with one of the company’s banking solutions.

First and foremost, not all sportsbooks that offer Interac e-Transfer deposits also provide the service when it comes to withdrawals. As established, Interac can be used for this purpose, but certain bookies have not yet implemented Interac e-Transfer as such.

In addition, this service does not offer a Loyalty or VIP program at the time of writing. While such promotions can be taken advantage of when it comes to the bonuses offered by your bank, this will nonetheless be a disappointment for punters who have come to expect such features from their payment method providers.

In terms of security, Interac has done an excellent job of implementing modern technology in order to keep your data safe. However, the fact that customers are notified via email does put certain users at risk of phishing.

Last but not least, gambling enthusiasts residing in Canada are the only ones who will be able to take advantage of this service. Punters who live abroad will instead need to hope that their country already offers, or is planning to implement, something similar to Interac in the near future.

Regulation and Availability of Interac

One cannot overstate just how big Interac is in Canada, and given the scale of its operations, it is only natural that an organization of this scale needs to be monitored by reputable regulatory bodies.

Interac’s e-Transfer service, in particular, has recently been put under close observation of the Bank of Canada. This decision was reached due to how crucial Interac e-Transfer has proved for the country’s economy, especially considering current global circumstances. As for the Bank of Canada itself, it is the country’s central financial institution and it is a so-called “crown corporation”. In layman’s terms, this is a major organization of the highest caliber, which is why it is tasked with overseeing services such as Interac e-Transfer.

In addition, the Financial Consumer Agency of Canada is another important player here. It is the governing agency responsible for regulating Interac Corporation itself. The FCAC is an independent organization that ensures that entities such as Interac Corporation comply with all necessary regulations.

As for where bettors can make use of what Interac Corporation has to offer, the company’s products are geared towards Canadians exclusively. In addition, one must have an online bank account at a Canadian financial institution, thus foreign sports betting fans will need to look elsewhere.

Interac Security

When you conduct transfer via Interac e-Transfer or Interac Online, your data is kept safe through the utilization of Secure Socket Layer encryption. Apart from Interac, banking institutions, as well as trustworthy sportsbooks, make good use of encryption technology as well.

In addition, you will need to authenticate your transactions on Interac’s end, as well as your financial institution’s end. The utilization of security questions and answers makes this all the more robust, and Additionally, your Interac password and IDs are kept confidential. The login process and transaction procedures are all protected by multiple layers of security, including two-factor authentication.

Do not forget to protect yourself as well, however, especially since you will receive transaction information via SMS and email.

Keep all of your relevant login and transaction information a secret, and avoid recklessness when you read your emails. Since Interac works via email, it is especially important to know what to look for when it comes to a scam practice called phishing. If you are marked as a potential victim, you will be sent seemingly legit emails that appear to have come from either Interac, your financial institution, or your sportsbook. This is done with the aim of tricking you into providing your confidential data to the scammer. Such fake emails tend to have obvious tells, however, such as the actual email source not being official. In addition, no credible institution would ever request crucial information via email, especially unprompted.

Lastly, Interac has a subsidiary company named 2Keys which focuses on cyber-security solutions. Interac Corporation acquired this company in 2019, which is yet another testament to the service provider’s ambitions to make its services as secure as possible.

| Interac Security Summary | |

|---|---|

| SSL | yes |

| Two-factor authentication | yes |

| Face ID | yes |

| Touch ID | yes |

| App/SMS Notifications | yes |

Interac Loyalty Program

Interac does not have any loyalty programs at the time of writing. Do note, however, that Interac is directly tied to your financial institution. This means that any loyalty programs associated with your bank account are something you can take advantage of even as an Interac user.

Loyalty programs can take many forms when it comes to banking institutions, the first and most popular of which are loyalty points-based promotions. As one can tell from the name, these types of programs allow you to earn points gained through transactions and other means, and then use said points in order to redeem various rewards. The prizes in question can include gift cards, financial rewards, and in the case of Royal Bank Canada, you can even use your points to pay down your credit card balance, pay your bills, etc.

Although bookie transactions will often not count towards receiving loyalty points, this type of program still benefits punters in an indirect way. After all, if you can save from other expenses, you are left with more funds than can go towards your sports betting hobby. There are other programs that operate similarly, such as ones that offer discounts on payments such as gas, student loans, and so on. Referral bonuses are also common, as are tier-based loyalty systems where the higher your balance, the higher the tier and benefits you get.

Interac Customer Support

Unfortunately, things can and do occasionally go wrong in the world of online finance, and even the most cautious and careful of users can run into a problem at some point. This is why it is always good to be prepared and know who to contact in such situations.

Interac, has, of course, foreseen this happening thanks to how much experience the company has with providing assistance to Canadian customers. However, the way things proceed here is a bit unique compared to other payment solutions.

Although Interac does offer customer support when it comes to problems such as phishing and the like, if you come across an issue specifically concerning Interac e-Transfer, for instance, it is not Interac you should reach out to. Instead, you will need to make use of the customer support services of your bank. In such cases, your financial institution is the only entity that can assist you in fixing whatever issue you have run into. As for how to do so, there are several ways. First, taking the trip to a land-based building of your bank is an option. If this proves to be impossible, or you would rather try and get help from the comfort of your own home, then you could also contact a representative via online live chat, email or telephone.

Interac Reviews from Around the Web

It is difficult to imagine Canada’s current financial landscape without Interac. The company’s e-Transfer service, for instance, is used by the general public quite a lot, both when it comes to transactions between family members and acquaintances, and those who either run small businesses or purchase products from said businesses.

Experienced Canadian punters who love to partake in wagering on sports are also familiar with Interac’s products. This is why there are a lot of Interac reviews written by betting experts on the web, and they can assist you in deciding whether or not Interac’s payment solutions are the right choice for you.

As for general user reviews, there is not much to be found at Trustpilot or any customer review website for that matter. However, this does not mean that regular users do not share their Interac-related opinions elsewhere. Many individuals have talked about their experiences with Interac e-Transfer and Interac Online over at the PersonalFinanceCanada subreddit.

Negative Interac Reviews

Most negative experiences with Interac’s e-Transfer service, in particular, showcase an issue we touched upon previously. Namely, a seemingly common experience is for customers to fall victims to phishing since e-Transfers are conducted through email. As established, phishing is a technique through which scammers, posing as a legit institution, trick users into giving them their login or banking information. This can be achieved by either asking the potential victim for their personal details outright or directing them to a fake website where they will be instructed to input their email, password, credit card number, etc. Other types of issues include customers being sent a fraudulent e-Transfer which, when accepted, will prevent the client from being able to utilize e-Transfer from that point onward.

Money not reaching the intended recipient due to an error is also something reported by users. In addition, certain individuals also have complaints regarding customer service, due to having found themselves stuck in a loop between the customer support teams of their financial institution and Interac.

Last but not least, Interac e-Transfer not always being instant is also a concern of some users.

As for Interac Online, it seems that it is its scarcity that individuals address more than anything. This is understandable, given that few banks offer Interac Online debit cards to their customers.

Positive Interac Reviews

Interac’s services are often praised for the convenience they provide to Canadians. Many clients express that they really appreciate how exchanging money between friends and family is as easy as just sending them an email and the answer to a security question. Evidently, even landlords and tenants have started utilizing Interac e-Transfer for rent payments due to this.

In addition, the fact that Interac’s products are directly tied to one’s bank account is also a point of praise. With other services like e-wallets, for instance, it is necessary to create a new account at the payment solution’s website. Then, the user must go through a number of extra steps, including identity verification and transferring money from their bank account to the new website. In comparison, Interac e-Transfer enrollment is simply a matter of logging into your already existing bank account and enrolling, making it far easier to use in general.

Finally, users are also pleased that more and more financial institutions have started offering Interac e-Transfer completely for free.

Conclusion

At the end of the day, it will be difficult for Canadian punters to find something on par with what Interac offers to its customers. Especially when it comes to banking methods that can be used for sports betting on the web.

The fact bettors can effortlessly make deposits is a great perk, and as emphasized previously, Interac users also have the great advantage of being able to conduct transactions involving withdrawals.

Moreover, punters can rest assured that the transactions in question will always be safe thanks to the multiple layers of protection Interac employs in order to keep your data secure. In addition, Interac’s services are closely tied to your bank account, which means that your financial institution is yet another organization tasked with the deed of protecting your information in modern and robust ways.

At the end of the day, an impressive number of sports betting aficionados are fond of using this solution, and if Interac Corporation keeps up the great work, we can see it becoming even more popular with time.

Overall User ExperienceI

Overall User ExperienceI